The Modern Way To Invest In Real Estate

We make real estate investing simpler, more transparent, and accessible to individual investors.

The Modern Way To Invest In Real Estate

We make real estate investing simpler, more transparent, and accessible to individual investors.

BY THE NUMBERS

9

Properties

200K

Square Footage of Properties

220+

Number of Tenants

$ 44M

Value of Properties

BY THE NUMBERS

9

Properties

200K

Square Footage of Properties

220+

Number of Tenants

$ 44M

Value of Properties

The Ram Realty Trust Advantage

-

Interests Aligned

We invest our capital with yours. Every day we profit together as our team makes decisions to optimize each real estate investment. It's our job & we love it.

-

Diversification

With multifamily investing, you decrease your risk and increase your returns.

-

Accessibility

Become a partner with as little as $1000.

-

Completely Passive

Ram Realty Trust’s vertical integration includes a property management company, construction company, & a real estate investment firm.

-

Increased Tax Benefits

Many of our real estate investments have large tax deductions which result in an 80%+ tax shield.

This website does not constitute, and should not be interpreted as, an offer to sell securities or a solicitation to buy securities. An offer may be made only to qualified investors who have registered with us, through a Confidential Investor Disclosure Document.

Established Track Record

We are proud to offer institutional quality deals to investors seeking to build wealth through commercial real estate. Our straightforward approach focuses on: offering smart diversification strategies, generating cash flow, and creating value in office, retail, and apartment buildings.

-

$2M +

Paid Out to Our Investors

-

$44M +

Property Value Financed

-

1000 +

Registered Membership Base

Our Portfolio

-

Arka Heights

Monroe, NC

Monroe, NC

Units

210

Cash on Cash Return

22%

Target IRR

50%

-

The Gateway

Indian Land, SC

Indian Land, SC

Sq. Ft.

18,000

Cash on Cash Return

14%

Target IRR

20%

-

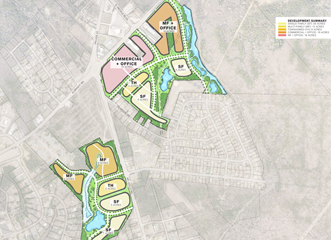

Albright Corners

Rock Hill, SC

Rock Hill, SC

Acres

107

Cash on Cash Return

28%

Target IRR

100%

Frequently Asked Questions

-

How Do I Get Started? Begin the process to set up an SDIRA account by clicking “Invest” on the RAM REIT I. You will be prompted to select the form of ownership for your investment. Select “Retirement,” then choose to either open a new SDIRA with our preferred custodian, IRA Services Trust, or use an existing SDIRA. -

Can I Automatically Reinvest My Distributions? Yes. If you elect to participate in our distribution reinvestment plan, any distributions may be automatically reinvested, allowing you the potential to realize a compounded return. -

Will The Distributions I Receive Be Taxable As Ordinary Income? REIT distributions may be treated as ordinary income, capital gains, and/or return of capital for tax purposes, each of which may be taxed at a different rate for different investors. As each investor’s tax considerations are different, it is recommended that you consult with your tax advisor. You also should review the section of the offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in repurchase of shares and liquidating distributions. -

Can I Invest In RAM REIT Offerings Using A SDIRA (Self-directed Ira) Or Other Type Of Retirement Account? Yes. We may accept retirement funds into our REIT offerings. This means you can use your Self-Directed IRA (“SDIRA”) to make investments. The minimum initial investment in a REIT offering using a retirement account is $5,000. Subsequent investments may be made at a minimum of $1,000. -

What Is A Self-directed Individual Retirement Account (SDIRA)? A self-directed Individual Retirement Account is a retirement account that provides investors with certain tax benefits for retirement savings. Self-Directed IRAs are held by a trustee or custodian that permits investment in a broader set of assets than is permitted by most IRA custodians, such as real estate, promissory notes, tax lien certificates, and private placement securities. -

What Types Of Accounts Are Eligible For Transfer Into A Self-directed Ira? You can transfer funds from a 401(k), 403(b), 457 or other qualified retirement plans into a self-directed IRA.